|

|

|||||||

| Coffee Shop Talk of a non sexual Nature Visit Sam's Alfresco Heaven. Singapore's best Alfresco Coffee Experience! If you're up to your ears with all this Sex Talk and would like to take a break from it all to discuss other interesting aspects of life in Singapore, pop over and join in the fun. |

|

|

|

Thread Tools |

|

#1

|

|||

|

|||

|

An honorable member of the Coffee Shop Has Just Posted the Following:

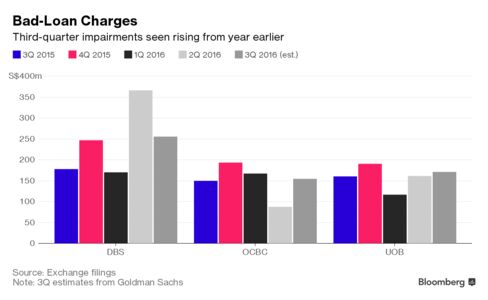

Bad Loan Charges to Hit Singapore's Three Biggest Banks Singapore’s three largest banks are poised to report higher impairment charges for loans to the struggling oil and gas industry and weaker interest margins when they post third-quarter earnings in coming days. DBS Group Holdings Ltd. is expected to lead the increase in impairment charges of S$255 million ($183 million) for the period, a 43 percent jump from a year earlier, according to Goldman Sachs Group Inc. DBS, Singapore’s largest bank by assets, and Oversea-Chinese Banking Corp. will probably report a second consecutive quarterly profit decline, while United Overseas Bank Ltd. may post a 10 percent drop, analyst estimates compiled by Bloomberg News show.  Lenders are setting aside more money for loan losses tied to the oil and gas industry, which has been hurt by lower energy prices. Bank profits have also come under pressure from a weakening domestic economy and a slump in the Singapore interbank offered rate -- one of the benchmarks for local interest rates -- to a one-year low, which has curbed the amount lenders charge for loans. “Dark clouds are still hanging over the oil and gas sector, which is going to add a negative feel to the banks,” said Jeremy Teong, a banking analyst at Phillip Securities in Singapore. “Net interest margin weakness will become pronounced given this year’s drop in Sibor.” OCBC will report its September quarter results on Oct. 27, followed a day later by UOB. DBS is due to publish its numbers on Oct. 31. Net income at DBS and OCBC fell 2.6 percent and 2.2 percent, respectively, from a year earlier according to the average of six analysts’ estimates compiled by Bloomberg. UOB may report a 10 percent drop, according to five estimates. Healthy Buffers Goldman Sachs analyst Melissa Kuang estimates OCBC’s impairment charges increased 3.4 percent, while UOB’s jumped almost 7 percent, according to a report earlier this month. The emergence of more oil and gas-related nonperforming loans will cause lenders’ bad-loan ratios to “rise modestly,” Fitch Ratings said in a separate note. Still, the banks are “securely positioned” to withstand further asset-quality deterioration because of “their disciplined underwriting standards and healthy provision buffers,” Fitch said. Close all those tabs. Open this email. Get Bloomberg's daily newsletter. More Singaporean companies tied to the oil and gas industry are facing difficulty repaying debt as demand for their services falls. Swissco Holdings Ltd., which supplies rigs and support vessels to oil and gas explorers, signaled last week that it may be in default due to its failure to pay interest due earlier this month. Companies including KS Energy Ltd. and AusGroup Ltd. have sought more lenient repayment conditions from their debt holders.Charges for oil and gas loans gone sour dragged on bank earnings in the second quarter: DBS’s profit dropped 6 percent as provisions for troubled energy-services firm Swiber Holdings Ltd. overshadowed gains in interest and fee income, while OCBC, Singapore’s second-largest bank, reported a 15 percent profit decline. For a story on the difficulties in Southeast Asia’s oil and gas services industry, click here. Meanwhile, borrowing costs have slumped this year as the local dollar strengthened, causing the three-month Singapore interbank offered rate to fall by 0.6 percentage point in the July-September period. Lenders price their domestic loans in part on interbank rates. DBS’s net interest margin, a measure of profitability based on interest income, may drop to 1.75 percent in the third quarter, from 1.78 percent a year earlier, Aakash Rawat, an analyst at UBS Group AG in Singapore, said in an Oct. 13 report. OCBC’s margin probably shrank 2 basis points to 1.64 percent, while UOB’s may have fallen 13 points to 1.64 percent, Rawat estimates. Singapore’s weaker economy is also weighing on credit growth, with total loans at banks operating in the city declining 1.6 percent in August from a year ago, according to preliminary data from the Monetary Authority of Singapore. The contraction was mostly in sectors including financial institutions and manufacturing, while consumer loans continued to grow, the data show. Gross domestic product fell an annualized 4.1 percent in the third quarter from the previous three months, the Ministry of Trade and Industry said Oct. 14. Manufacturing contracted at an annualized rate of 17.4 percent -- the worst quarter-on-quarter pullback since the third quarter of 2012. Before it's here, it's on the Bloomberg Terminal. LEARN MORE Click here to view the whole thread at www.sammyboy.com. |

| Advert Space Available |

|

| Bookmarks |

|

|

t Similar Threads

t Similar Threads

|

||||

| Thread | Thread Starter | Forum | Replies | Last Post |

| Which Banks' OL are hot? | KhunnTey | Adult Discussions about SEX | 88 | 16-06-2023 12:06 AM |

| Chitchat World's Banks are preparing for Hardship and Deaths, are you ready? | Sammyboy RSS Feed | Coffee Shop Talk of a non sexual Nature | 0 | 29-08-2016 09:00 PM |

| Chitchat World's Banks are preparing for Hardship and Deaths, are you ready? | Sammyboy RSS Feed | Coffee Shop Talk of a non sexual Nature | 0 | 29-08-2016 08:10 PM |

| Chitchat World's Banks are preparing for Hardship and Deaths, are you ready? | Sammyboy RSS Feed | Coffee Shop Talk of a non sexual Nature | 0 | 29-08-2016 08:00 PM |

| if banks not finished, nothing else will | Sammyboy RSS Feed | Coffee Shop Talk of a non sexual Nature | 0 | 23-02-2016 11:50 PM |